Credit card companies are aiming to keep debt on the rise and students have become a primary target.

Because of their financial inexperience, young adults between the ages of 18 and 25 are constantly bombarded with credit card offers. With students having little to no income, the promise of buy-now-and-pay-later is an offer that many students can’t refuse.

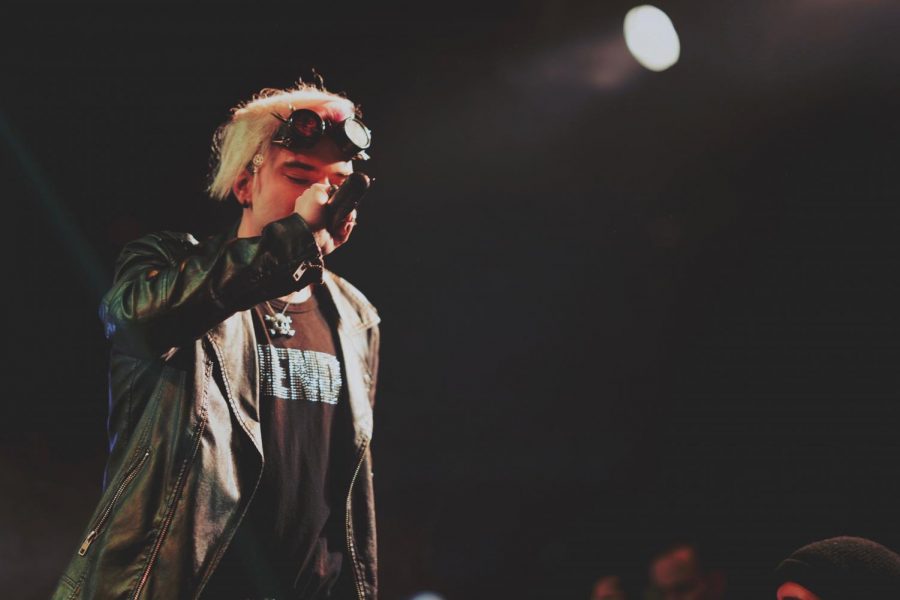

A comedian of 20 years has changed his routine in order to educate students about the dangers of credit card debt, and spoke to Business students at Moorpark College on March 8. Howie Walfish calls himself “The Credit Card Comedian,” and makes it perfectly clear that debt is no laughing matter.

“Seven to 10 percent of college students are dropping out of school because of credit card debt,” says Walfish. “I am hoping to start a grassroots movement saying something must be done.”

On March 8, Walfish spoke with Business students at the Moorpark College Campus at the request of Business Professor James Allyn. Walfish has faced approximately $157 thousand worth of credit card debt in his lifetime and has been through two personal bankruptcies. His hope is to create an awareness of credit card abuse that will spare future youth from his same experiences with debt.

“I can stand up and talk about [credit card debt] in a class room,” says Moorpark College Business Professor James Allyn. “But he has real life experiences and a unique presentation [which] I thought might be more interesting to students.”

Debt is more than just a financial problem. It affects people psychologically. A survey conducted by the Credit Awareness Resistance Education (C.A.R.E) program found that students are more afraid of debt than terrorism. Debt can be a great source of grief and anxiety for many people, especially when they don’t understand how it happened or how to fix it.

Walfish offers the following tips on how to avoid the perils of unrelenting debt:

(1) do not use a credit card for a purchase of less than $10. Only make a purchase with a credit card if you can afford it, set the money aside and pay it off immediately; and

(2) if you are already in debt, stop using your cards. Try to consolidate the debt and start paying it off. Ideally, try to pay off at least twice as much as the minimum amount due on your statement. ” I’m not 12 years of finance at Harvard law,” the Credit Comedian explains. “I lived through it.” More information on avoiding credit card debt can be found on the C.A.R.E website at www. careprograms.us.