The Senate voted 50-49 on Saturday to pass President Joe Biden’s proposed $1.9 trillion COVID-19 stimulus bill, also known as the American Rescue Plan, with amendments and no Republican support. The extensive legislation includes stimulus checks, unemployment extensions, small business assistance, funding for COVID-19 testing and vaccine distribution, funding for schools to reopen safely and more.

It was a party-line vote with all Senate Democrats voting yes and nearly every Republican in the Senate voting no.

Senate Minority Leader Mitch McConnell, a Republican from Kentucky, expressed his opposition to the bill on Saturday stating, “The Senate has never spent $2 trillion in a more haphazard or less rigorous way.”

According to The Washington Post, the bill will now go back to the House of Representatives on Tuesday due to the amendments passed by the Senate, where it is projected to pass and move on to Biden’s desk for signature by the end of this week.

USA Today reported on the most significant changes to the bill from the House version, which includes the elimination of a $15 federal minimum wage, more targeted stimulus checks, revised and reduced pandemic unemployment benefits, the exclusion of public transportation expansion and more provisions for how state and local governments can use the rescue plan’s aid.

Included in the updated legislation is $350 billion for state and local governments, $170 billion for schools, $25 billion for a new grant program that specifically helps bars and restaurants, $14 billion for vaccine development and distribution, and $8.5 billion for rural hospitals.

Here is a more in-depth look at stimulus checks and unemployment benefits:

Stimulus Checks

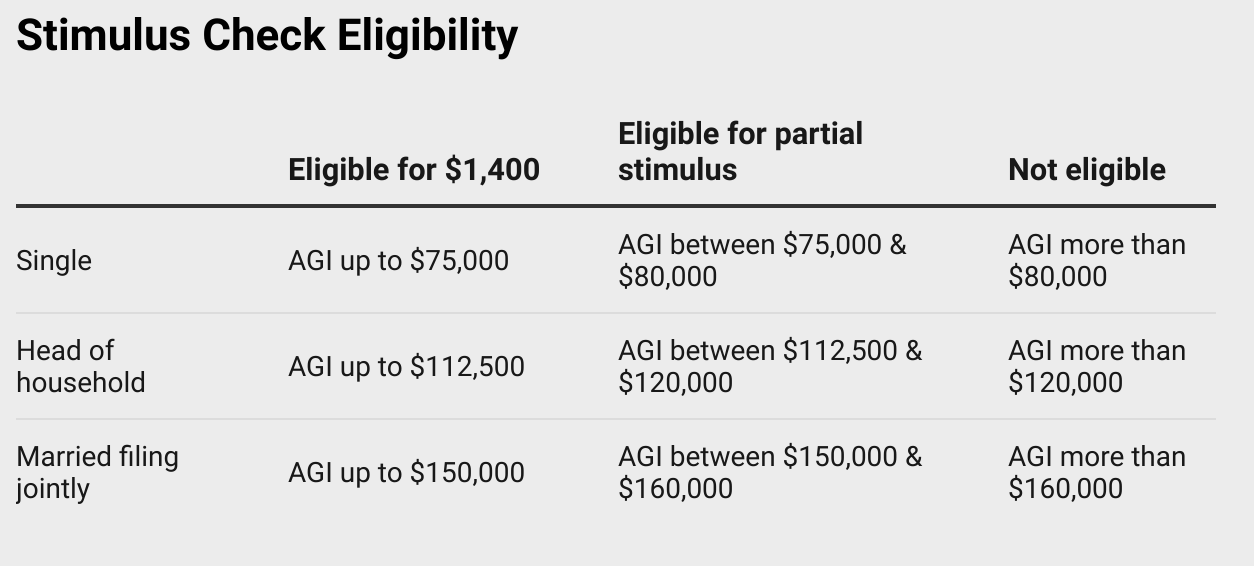

According to the revised American Rescue Plan, checks in the amount of $1,400 will be sent to those who filed their taxes as single, with a reported adjusted gross income (AGI) of no more than $75,000, individuals who filed their taxes as the head of household with an AGI of no more than $112,500, and couples who filed their taxes jointly with an AGI of no more than $150,000.

The stimulus checks begin to phase out from there, and cap for individuals with an AGI of up to $80,000, individuals who filed as the head of household with an AGI of up to $120,000 and couples who filed jointly with an AGI of up to $160,000.

To determine eligibility, the bill is set to use tax information from either 2019 or 2020, depending on what was last filed with the Internal Revenue Service (IRS).

Stimulus eligibility is expanded in this new legislation for dependents. The IRS describes dependents as, “a person other than the taxpayer or spouse who entitles the taxpayer to claim a dependency exemption.”

Taxpayers who claim dependents and have a qualifying AGI would receive $1,400 per dependent for all ages. Under these provisions, college students and those with disabilities who are dependents would now be included in the stimulus, a notable difference from previous COVID-19 stimulus bills.

Biden expressed optimism about the timeliness of stimulus checks on Saturday during his remarks made at the White House, suggesting that Americans will receive them beginning in March.

“This plan will get checks out the door, starting this month, to the American people who so desperately need the help,” stated Biden.

Americans who qualify for the stimulus can expect these checks to be delivered the way the last two stimulus checks were, through direct deposit or by mail using information the IRS obtains from previously filed tax returns.

Unemployment Benefits

This legislation extends current federal unemployment pandemic benefits of $300 per week until Sept. 6. The current extension from the last stimulus package signed into law by former President Donald Trump on Dec. 27, 2020, is set to expire on March 14.

The Senate also amended the most recent package to make up to $10,200 of unemployment benefits received tax-free by the federal government for individuals with an AGI of up to $150,000.

For more information regarding Ventura County’s COVID-19 pandemic response please visit their website.